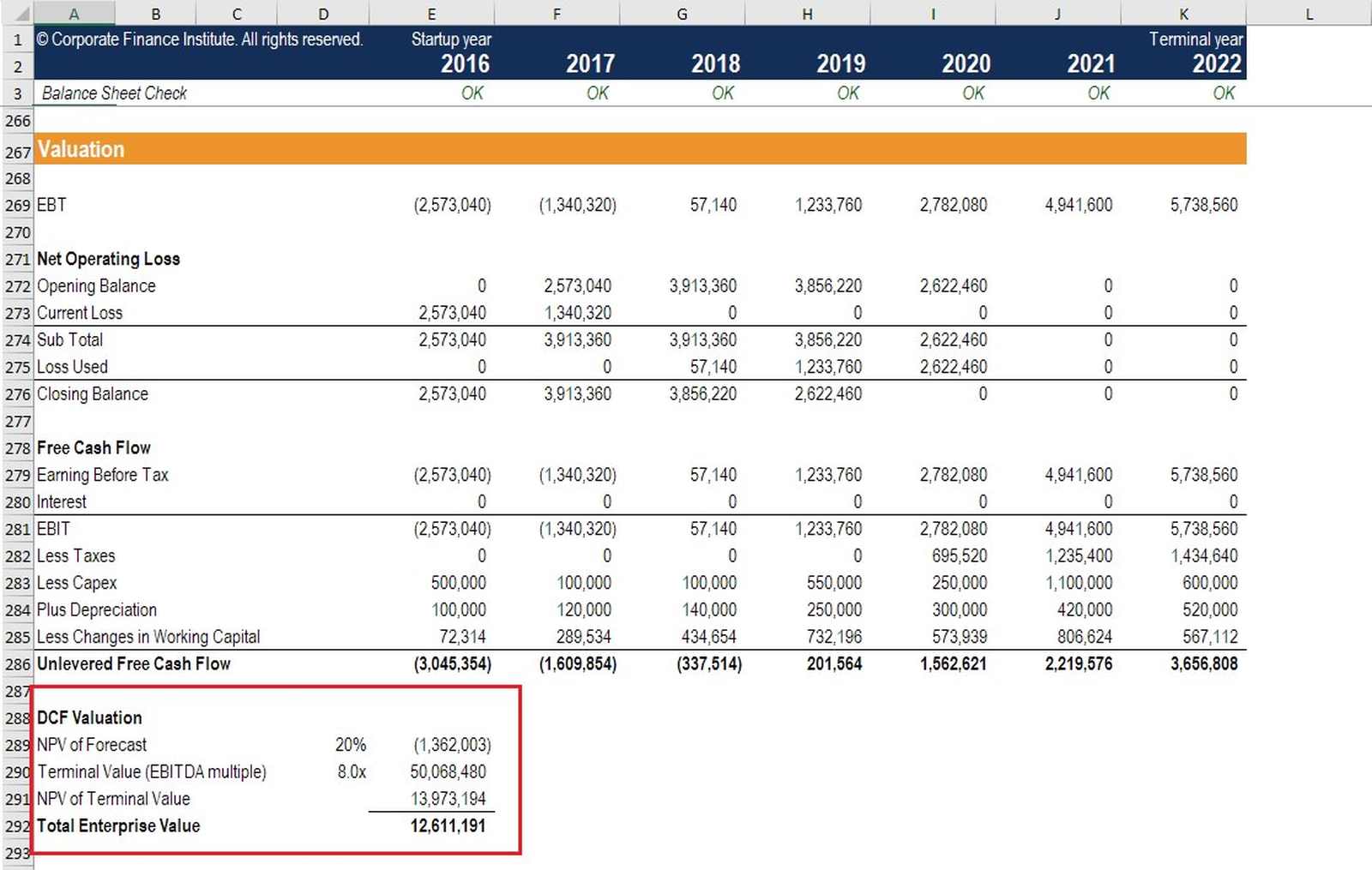

This is the complete guide to understanding changes in working capital operating working capital owner earnings and free cash flow fcf. Working capital current assets current liabilities. And the cash flow is the main factor we consider when valuing a company.

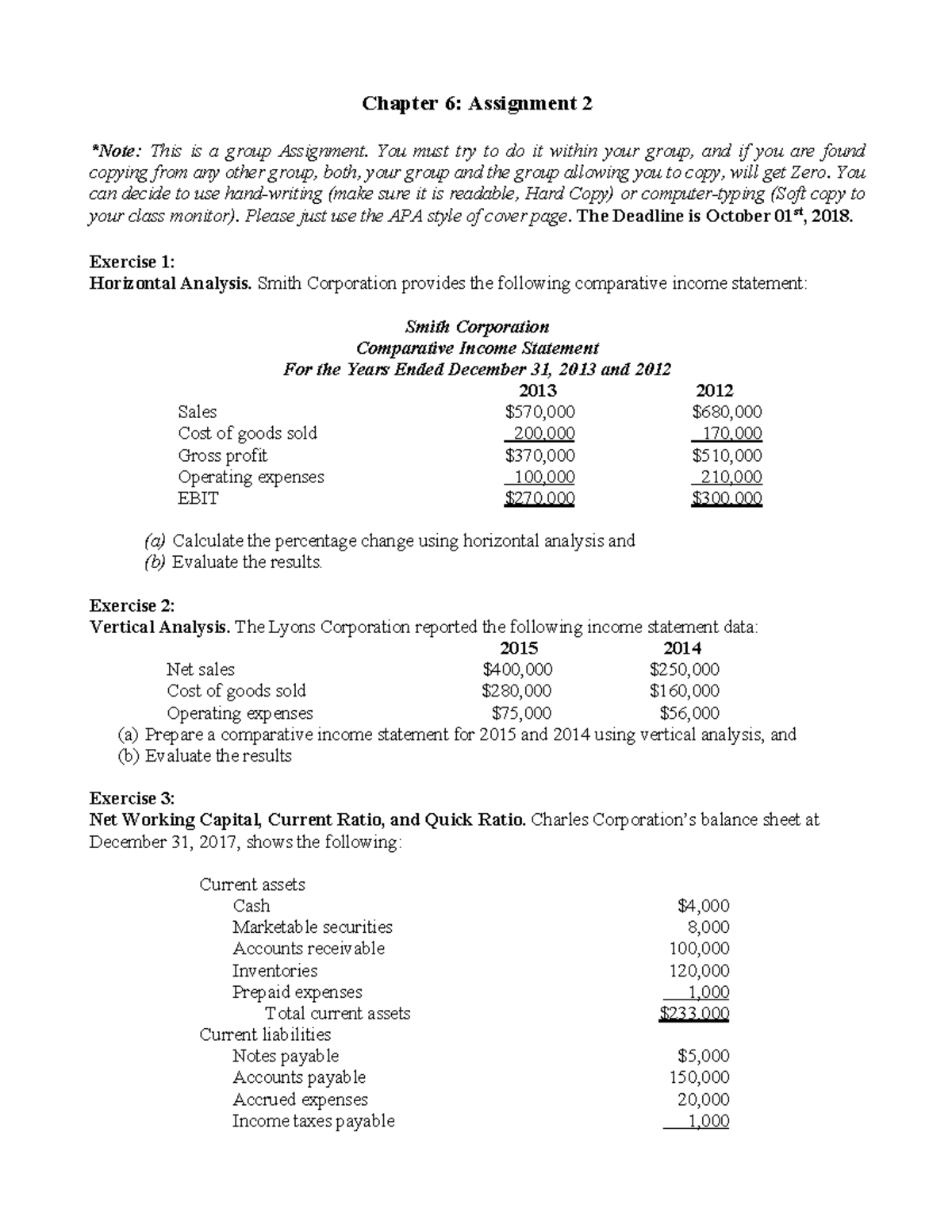

calculate change in net working capital

Impact Of Working Capital Management On Funding Strategies

Internal Rate Of Return Irr And Mirr Meaning Calculation And Use

Practice Exercise Mkt101 Introduction To Marketing Studocu

Change in working capital calculation is done in cash flow statement preparation.

Calculate change in net working capital.

Examples of these formulas include the free cash flow to equity formula and free cash flow to firm formula.

Net working capital is used in various other financial formulas that deal with cash flows.

Any increase in revenue will also generally show an increase in working capital.

Anything higher could indicate that a company isnt making good use of its current assets.

What the change really means in change in working capital the difference between.

In the formula for free cash flow to equity the change in net working capital is subtracted.

Change in net working capital is calculated as a.

The net working capital formula is calculated by subtracting the current liabilities from the current assets.

Net working capital in very simple terms is basically the amount of fund which a business needed to run its operations on a daily basis.

The change in the working capital will have a direct impact on the cash flow from operations.

Net change in working capital 1033 850 183 million cash outflow analysis of the changes in net working capital.

It means the change in current assets minus the change in current liabilities.

Typical current assets that are included in the net working capital calculation are cash accounts receivable inventory and short term investments.

In other words it is the measure of liquidity of business and its ability to meet short term expenses.

This parameter is very important in terms of analyzing companies operational efficiency.

What they mean the formulas for how to calculate them and examples.

The net working capital ratio can be calculated as follows.

Current assets current liabilities the optimal ratio is to have between 12 2 times the amount of current assets to current liabilities.

Change in working capital does mean actual change in value year over year ie.

Here is what the basic equation looks like.

Fcff And Fcfe Of Cv Free Cash Flow Business

Free Cash Flow Formula Top 3 Fcff Formula You Must Know Youtube

How To Calculate Change In Working Capital

The Balance Sheet Boundless Accounting

Net Working Capital Guide Examples And Impact On Cash Flow

Net Working Capital Guide Examples And Impact On Cash Flow

Working Capital How To Calculate Using Easy Formulas Fast Capital 360

Calculate The Change In Net Operating Working Capi Chegg Com

Working Capital Change Spending Formula Operating Requirement

0 comments:

Post a Comment