This free easy to use payroll calculator will calculate your take home pay. Hourly rates weekly pay and bonuses are also catered for. The tax calculator uses tax information from the tax year 2019 2020 to show you take home pay.

take home pay calculator texas uk

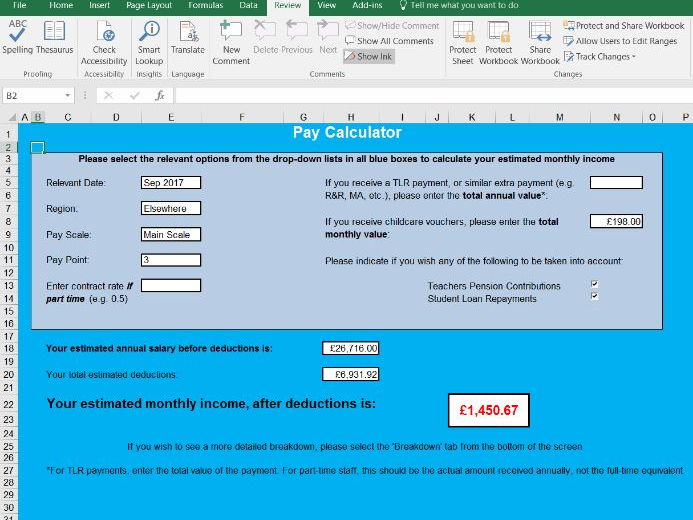

Pay Calculator By Tafkam Teaching Resources

20000 After Tax 2019

How To Calculate Process Retroactive Pay

This calculator gives results based on tax brackets of both 2018 and 2019 tax brackets tax cuts and jobs act or trump tax.

Take home pay calculator texas uk.

Please note that it is mainly intended for use by us.

How to use the take home calculator.

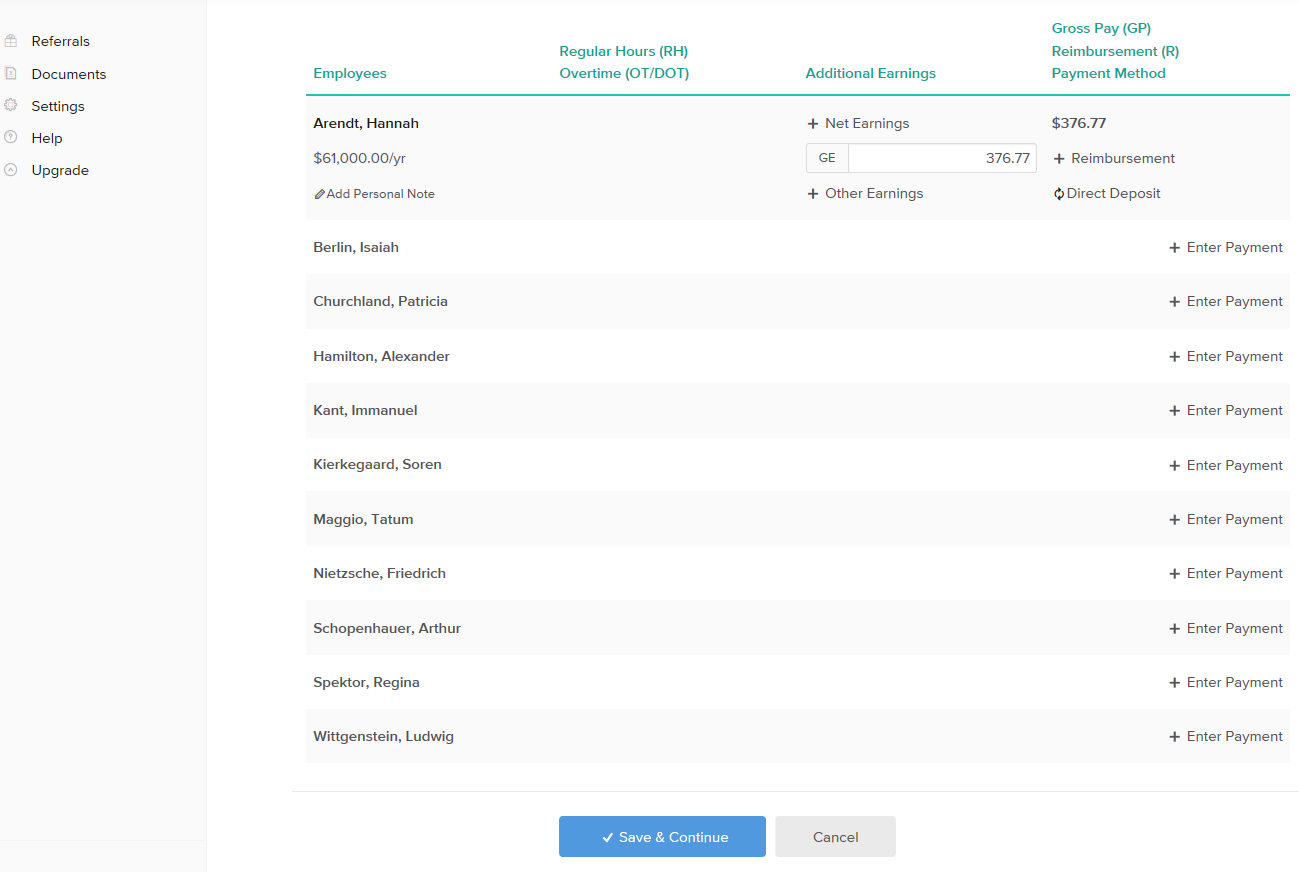

Use the take home pay calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Its important to review these values as theyll impact the take home calculations when breaking down by hour day and week.

Standard deductions to your take home pay include student loan repayments plan 1 and plan 2.

Enter the number of hours and the rate at which you will get paid.

Now updated with tax withholding guidelines based on the new tax plan.

Why not find your dream salary too.

The calculator wont be accurate if you pay by salary sacrifice.

Your take home pay amount is the amount of money you earn each pay period after taxes.

Use smartassets texas paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Calculates federal fica medicare and withholding taxes for all 50 states.

See where that hard earned money goes with uk income tax national insurance student loan and pension deductions.

While it can be difficult to calculate your take home pay with an actual calculator there is a way to just plug in some numbers and have the amount automatically calculated for you.

If you pay into a pension via the paye system on a monthly basis enter the amount here.

To use our texas salary tax calculator all you have to do is enter the necessary details and click on the calculate button.

Find out the benefit of that overtime.

How to use the take home pay calculator.

Using our texas salary tax calculator.

There are two options in case you have two different overtime rates.

It also defaults to 5 working days per week and 75 hours per day 375 hours per week.

More information about the calculations performed is available on the about page.

For example for 5 hours a month at time and a half enter 5 at 15.

This breakdown will include how much income tax you are paying state taxes federal taxes.

This assumes you pay your pension from net pay and thus get tax relief on contributions from hmrc.

After a few seconds you will be provided with a full breakdown of the tax you are paying.

Supports hourly salary income and multiple pay frequencies.

To keep the calculations simple overtime rates are based on a normal week of 375 hours.

This can be in percentage format eg.

The salary calculator tells you monthly take home or annual earnings considering uk tax national insurance and student loan.

The latest budget information from april 2019 is used to show you exactly what you need to know.

Small Business Salary Paycheck Calculator Adp

What Is Net Pay Definition How To Calculate Video Lesson

Steps To Take In Calculating Capital Gains For Selling Foreign Property

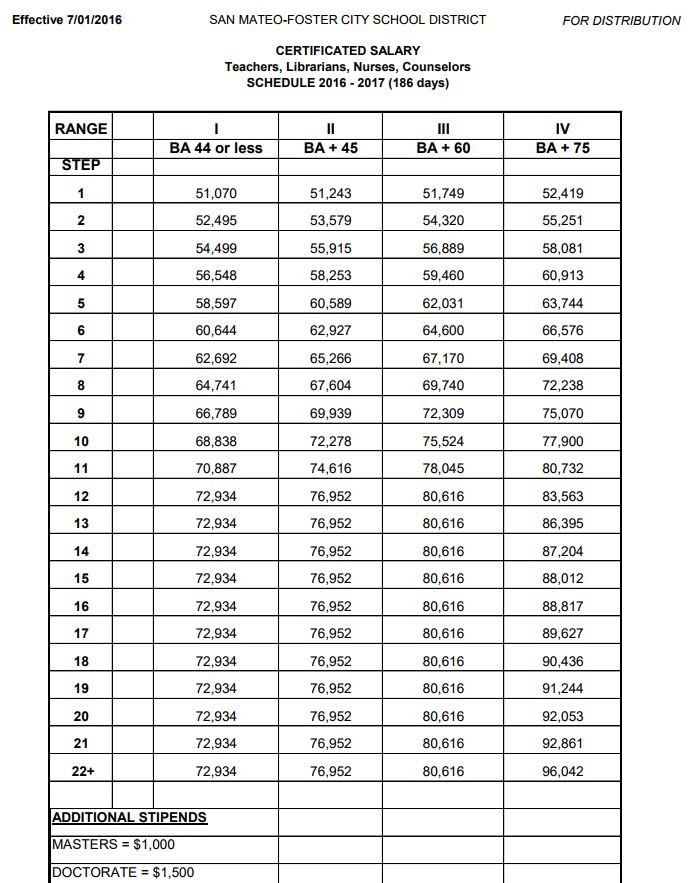

Teacher Salary Teacher Org

Paycheck Calculator Take Home Pay Calculator

52 000 Income Tax Calculator Texas Salary After Taxes

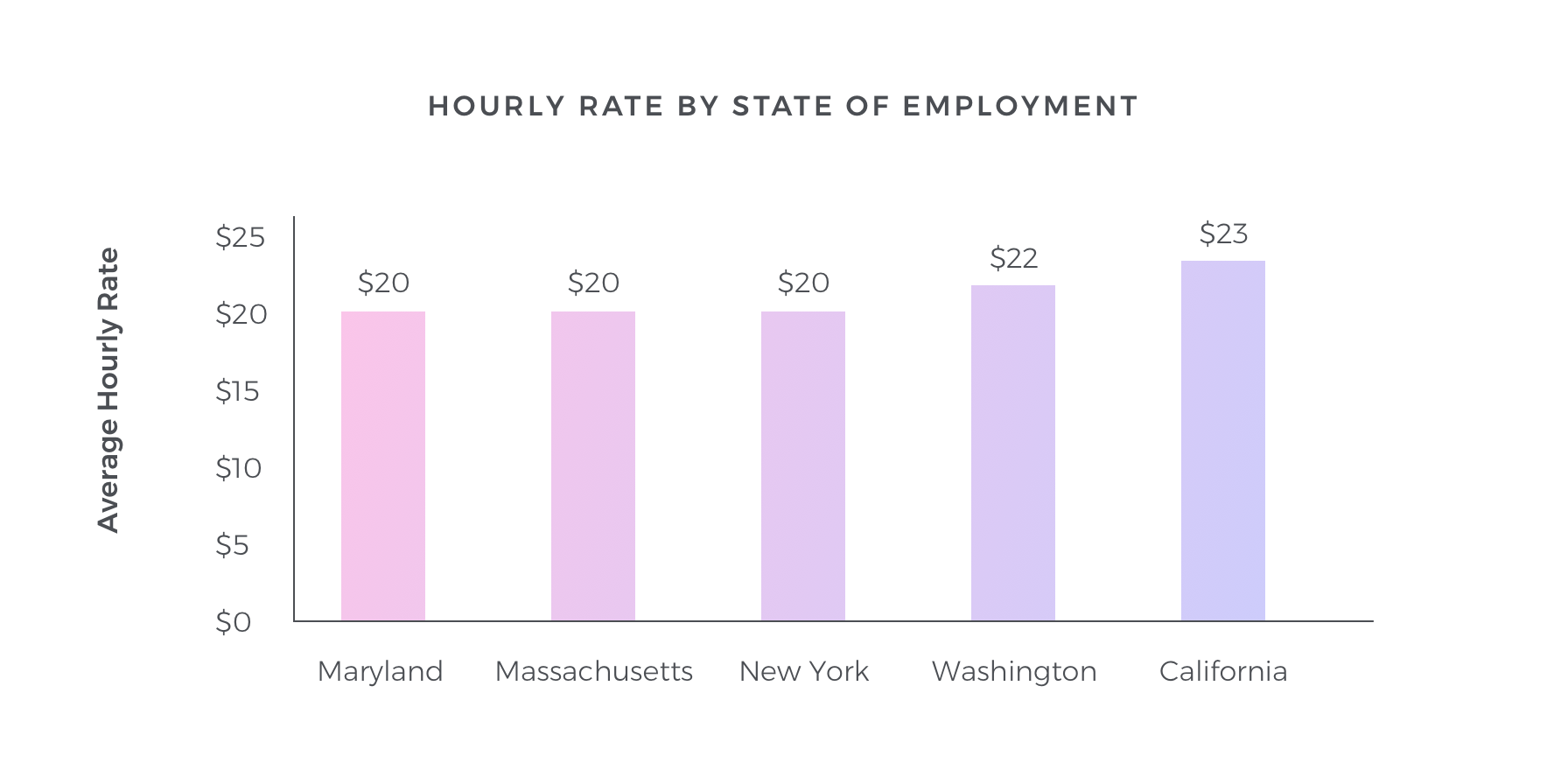

How Much Do I Pay A Nanny Nanny Lane

:brightness(10):contrast(5):no_upscale()/537892387-57a54ada3df78cf459977d92.jpg)

Free Salary Cost Of Living And Paycheck Calculators

Texas Sales Tax Guide For Businesses

0 comments:

Post a Comment