This estimator is based on median property tax values in all of new yorks counties which can vary widely. A propertys annual property tax bill is calculated by multiplying the taxable value with the tax rate. Your property tax rate is based on your tax class.

nyc property tax rate calculator

State Income Tax Wikipedia

Nyc S Most Expensive Apartments Have The Lowest Tax Rates Metrocosm

New York Property Tax Calculator Smartasset Com

Learn how to calculate your annual property tax.

Nyc property tax rate calculator.

New york property tax calculator.

In the us property taxes even predate income taxes.

Estimate the propertys market value.

The property tax database calculates the combined property tax rate and total average property tax bill including schools and local governments in every new york locality.

The nyc real property transfer tax is a seller closing cost of 14 to 2075 which applies to the sale of real property valued above 25000 in new york city.

You can calculate the amount you pay in property taxes by multiplying.

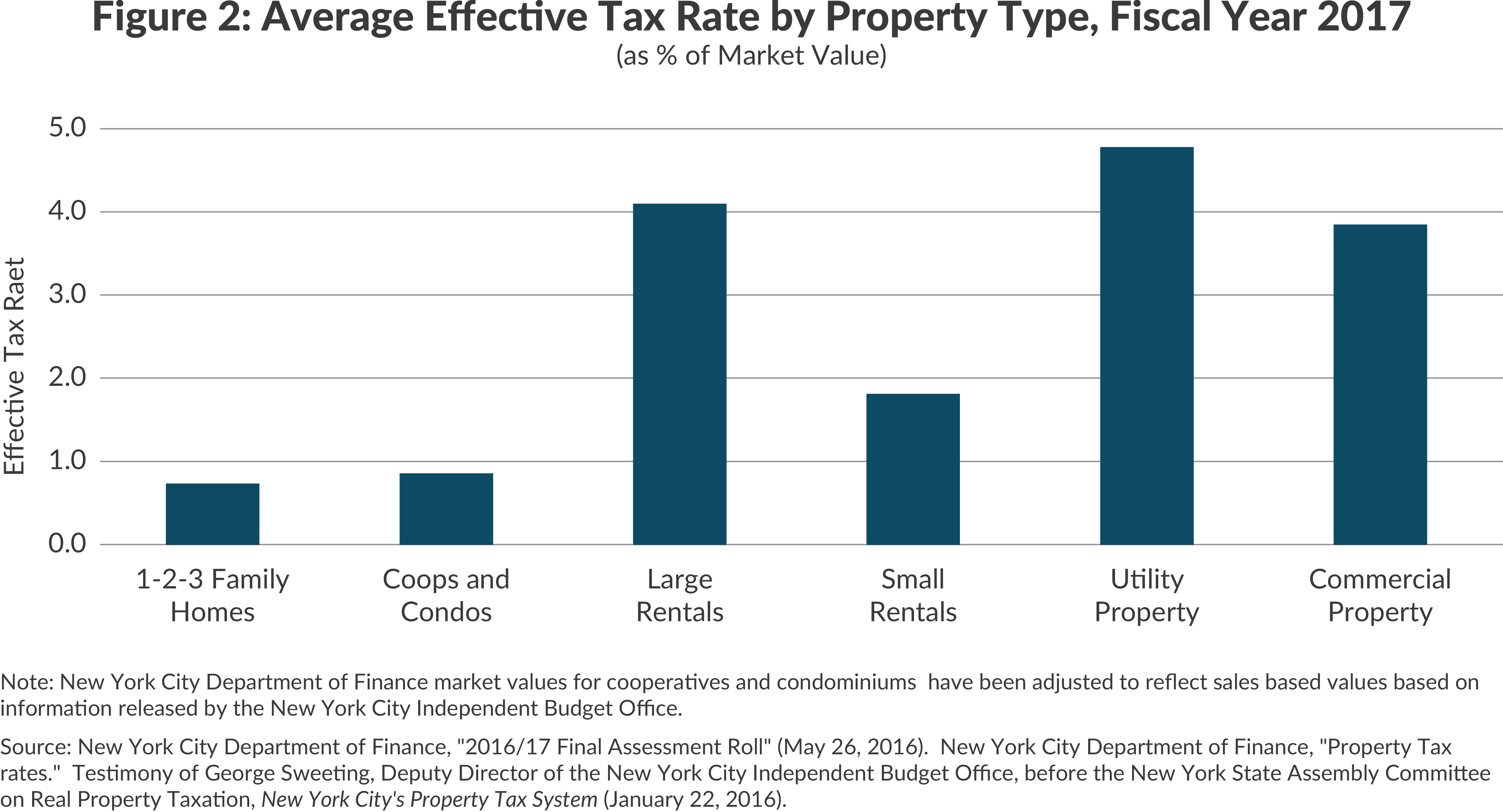

The tax rates are listed below.

In new york city property tax rates are actually quite low.

The department of finance determines the market value differently depending on they type of property you own.

Use this database to calculate the all in property tax bill in a given locality or to compare property tax burdens among multiple localities.

Look up your propertys tax assessment.

New york has one of the highest average property tax rates in the country with only three states levying higher property taxes.

New yorks median income is 74777 per year so the median yearly property tax paid by new york residents amounts to approximately of their yearly income.

The average effective property tax rate in the big apple is just 080.

Use our free new york property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics.

The tax rates for school districts municipalities counties and special districts.

Property taxes are one of the oldest forms of taxation.

Property tax rates for tax year 20182019.

While some states dont levy income tax all states as well as washington dc.

The median property tax on a 30600000 house is 376380 in new york the median property tax on a 30600000 house is 321300 in the united states please note.

How property taxes are calculated.

There are four tax classes.

In fact the earliest known record of property tax dates back to the 6th century bc.

Your propertys taxable assessment your assessment minus any exemptions x.

Property taxes in new york vary greatly between new york city and the rest of the state.

The statewide average rate is 165.

2019 S Property Taxes By State

Understanding The Difference Between Market Value And Assessed Value

New York City Property Taxes Cbcny

2019 S Property Taxes By State

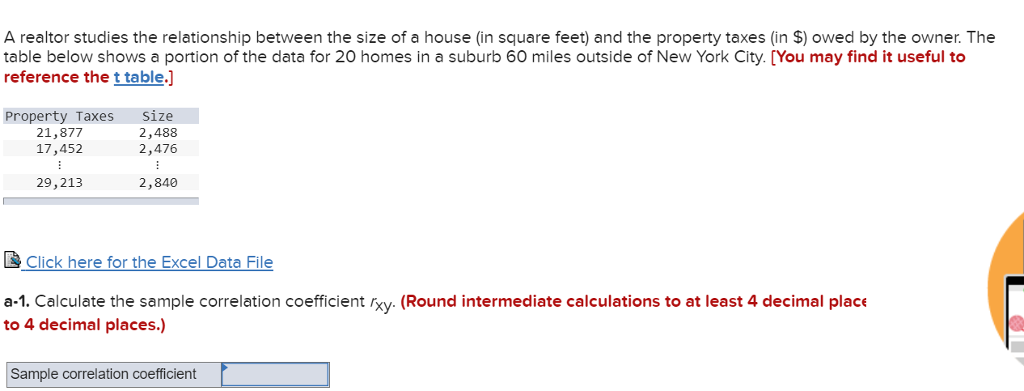

Solved A Realtor Studies The Relationship Between The Siz

Income Tax Guide For 2018 The Simple Dollar

Nyc S Most Expensive Apartments Have The Lowest Tax Rates Metrocosm

Estimated Closing Costs Warburg Realty Warburg Realty

Nyc 311 If You Are A Property Owner In New York City Facebook

0 comments:

Post a Comment