Irs telephone assistors dont have any. Individual income tax return for this year and up to three prior years. Is fast easy and safe.

where's my refund nj

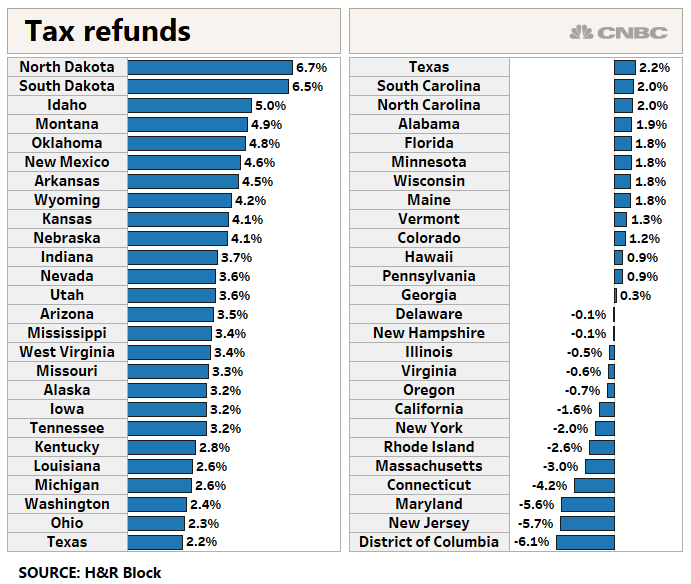

Unhappy With Your Tax Return How To Prepare For 2019

Where S My Refund Fact Sheet Eitc Other Refundable Credits

Here S Why Your Tax Refund May Be Disappointing This Year Video

These anti fraud protections need to be revised every year because perpetrators are becoming more adept at refund fraud.

Wheres my refund nj.

The irs issues most refunds in less than 21 days although some require additional time.

By using your social security number and estimated refund amount you can check the status of your new jersey nj state tax refund.

6 weeks or more since you mailed your return or when wheres my refund tells you to contact the irs.

What to do while youre waiting.

You can get refund information about your federal income tax return through the irss secure website 72 hours after they acknowledge receipt of your return.

Taxpayers who have access to a touch tone phone may dial 1 800 323 4400 within new jersey new york pennsylvania delaware and maryland or 609 826 4400 anywhere to learn the status of their tax refund.

Directs you to contact them.

Check the status of your form 1040 x amended us.

An automated script will lead you through the steps necessary to determine the amount of your tax refund.

You will need to enter 3 pieces of information from your efiled return.

Since refund fraud resulting from identify theft has increased we are using additional tools to protect new jersey taxpayers.

These enhanced efforts could result in early filers experiencing a slight delay in receiving their refunds.

Before making an inquiry please allow.

21 days or more since you e filed.

The best way to communicate with the tax department about your return is to create an online services account and request electronic communications for both bills and related notices and other notificationssimply.

New jersey state tax refund status information.

Remember when you e file your tax return you generally receive your income tax refund faster than paper filing.

Refer to our frequently asked questions for more information.

You should only call if it has been.

Where is my refund.

Their phone and walk in representatives can research the status of your new jersey state refund only if it has been 21 days or more since you filed electronically more than 6 weeks since you mailed your paper return or wheres my new jersey state refund.

The amended return tool cant access certain amended returns.

Nj Division Of Taxation Office Of Criminal Investigation Press

Nj Division Of Taxation

Burlington County Nj Cpa Kenneth J Gertie Cpa

Nj Division Of Taxation

Nj Division Of Taxation

Tax Refunds Delayed In Nj This Year Morristown Nj Patch

Nj Dos Nj Film Financial Incentives

Nj State Refund Status Businesses Nj State Tax Refund Status 2016

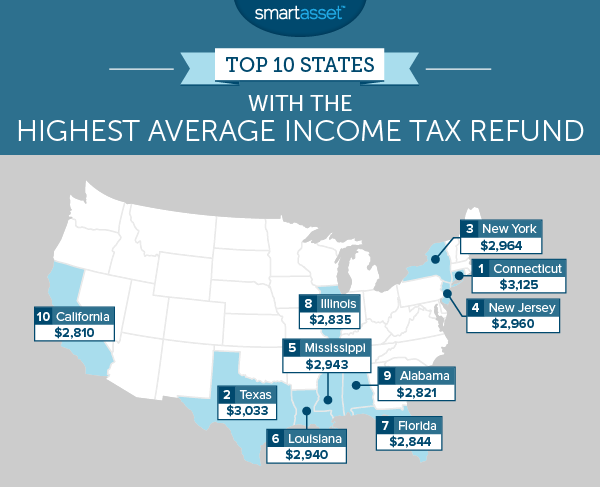

The Average Tax Refund In Every State Smartasset

0 comments:

Post a Comment