The first look period is the first 15 days a freddie mac or fannie mae property is on the market. The federal home loan mortgage corporation fhlmc conveniently named freddie mac is a government sponsored entity gse that buys mortgages from lending institutions in order to expand the secondary real estate market. This ongoing initiative offers owner occupant homebuyers neighborhood stabilization program nsp grantees and non profits engaged in community stabilization efforts the ability to purchase homesteps homes during their initial 20 days of listing 30 days in nevada cook county il and the city of detroit mi without competition from investors.

freddie mac first look initiative fha loan

View 63 Bullman St Phillipsburg Nj Mls 3531626

Fha Loans Ppt

Mortgage Programs For First Time Home Buyers

What is a homepossible matrix.

Freddie mac first look initiative fha loan.

Financing pre approval obtain home loan financing pre approval before making any offer on a freddie mac owned home.

Freddie mac first look initiative.

Freddie mac june forecast.

Freddie mac now owns the properties.

According to freddie macs june forecast low mortgage rates along with a strong labor market will help housing markets post modest growth over the next year and a half.

What is the freddie mac first look initiative.

Investors and 2nd homeowners are not allowed to make offers on these properties in that first 15 day period.

These are homes that freddie mac financed but the owners defaulted.

Freddie macs first look initiative ensures that only non profits and owner occupying buyers can submit offers during that initial period.

Freddie mac created the program to enforce some stabilization in specific communities.

By purchasing mortgages from banks and lenders freddie mac is putting more money into the market.

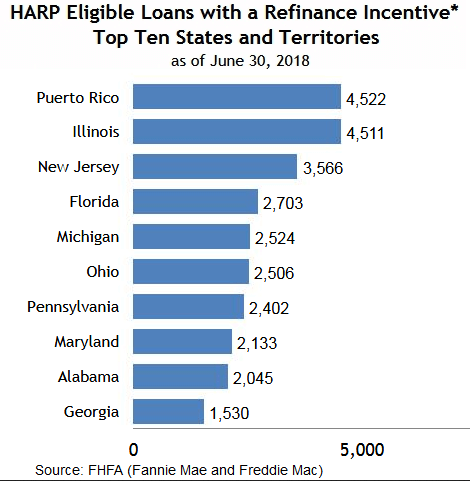

Loan look up tool to understand the options available for getting help with your mortgage including the federal home affordable refinance program harp its important for you to know who owns your loan.

April 8 2019 by jmchood when freddie mac takes possession of a home that foreclosed they put it in their homesteps program.

Click to see the latest mortgage rates.

It gives buyers who will occupy the property the first shot at it.

The first look initiative is offered by freddie mac that allows owner occupant homebuyers and select non profits the ability to purchase homesteps properties during the first initial 20 days of listing.

Favorable mortgage rates and strong labor situation signal growing housing market through 2019.

First lets look at the idea behind the freddie mac first look initiative.

Homepossible is a special loan program that is designed to help low to moderate income borrowers.

A large portion of your success in obtaining a freddie mac first look home at a good price depends on the experience and skill of your real estate agent.

Right now the program is available in 10 states.

Mls 1001184491 209 900 Www Calomeris Com 505 Tippin Ct Thurmont

3 5 Closing Cost Incentive Assistance For Homesteps Homes In Ca

Updated 2019 Texas Conforming Loan Limits Fha Va Conventional

58 Best Fha Loan Images Fha Loan Fha Mortgage Credit Score

Fha Mortgage Requirements And Guidelines A Detailed Look

What Is Harp And Do I Qualify For A Harp Loan

Homesteps More Questions Answered Freddie Mac

Mls 1001184491 209 900 Www Calomeris Com 505 Tippin Ct Thurmont

600 Old Bristol New Hampton Nh

0 comments:

Post a Comment