It instructs the broker to execute a trade when a stock reaches a price beyond which the investor is unwilling to sustain losses. Trailing stop orders are held on a separate internal order file placed on a not held basis. The trader cancels his stop loss order at 41 and puts in a stop limit order at 47 with a limit of 45.

stop loss vs stop limit buy

What Is Stop Loss Meaning And Strategy

Buy Stop Order Definition

5 The Stock Market Ppt Download

For buy orders this means buying as soon as the price climbs above the stop price.

Stop loss vs stop limit buy.

Knowing the difference between a stop loss vs stop limit order and when to use them is important.

It can assure that the trade to be made is at a specific price or better.

Also known as stop loss order it is a pending order used to buy or sell at the stop order price.

It is used to buy above the market price or sell below the market price if the.

It is a pending order used to buy or sell at the limit order price.

While they may sound similar they are in fact different.

The stop loss order is used when the market falls in order to avoid loss.

For example a trader might buy a stock at 40 expecting it to rise and place a stop loss order at 3975.

The downside of the stop loss order is that it becomes a market order once the stop loss level is triggered.

That means if xyz touches 15 in a fast moving market triggering the stop then it will have to hit 15 again the limit for the order to be executed.

If the stock price falls below 47 then the order becomes a live sell limit order.

Trailing stop orders may have increased risks due to their reliance on trigger pricing which may be compounded in periods of market volatility as well as market data and other internal and external system factors.

On the other hand an investor can place stop limit orders.

The video above explains the differences and our preference when using stop losses.

Stop loss and stop limit orders.

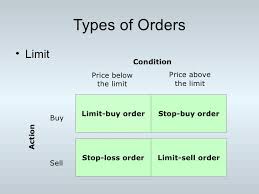

A stop limit order becomes a limit order not a market order when a specified price level has been reached.

A stop order sometimes called a stop loss order is used to limit losses.

Stop loss orders are designed to limit the amount of money that is lost on a single trade by exiting the trade if a specific price is reached.

Thus if the stock blows past the stop loss level due to a spike in volatility or major news event the sell order could be executed significantly below the anticipated level.

It is used to buy below the market price or sell above the market price.

Market Order Vs Limit Order Top 4 Best Differences With Examples

Types Of Orders Stop Loss And Take Profit Orders Fxopen Helpdesk

Executing Trades Trading Operations Metatrader 5

E Trade Limit And Stop Loss Orders On Stocks 2019

How To Make A Trade On Kucoin Kucoin Help Center

Order Types Explained Market Stop Loss Limit Stop Limit Ragingbull

How To Limit Risk And Take Profit For Pullback Trading Strategies

Stop Market Orders Stop Limit Orders How To Use Them Properly

How To Set Stop Limit On Binance Buy Crypto Shirts Rakeen

0 comments:

Post a Comment

Click to see the code!

To insert emoticon you must added at least one space before the code.