Business inventory is exempt from taxation. The annual bill which includes the general tax levy voted indebtedness and direct assessments that the department of treasurer and tax collector mails each fiscal tax year to all los angeles county property owners by november 1 due in two installments. To locate all taxable property in the county and identify ownership.

los angeles county tax collector payment

County Of Los Angeles Department Of The Treasurer And Tax Collector

Los Cerritos Community News Publisher Receives Questionable Tax

County Connect Homeowner S Resources

Payments will be accepted between the hours of 800 am 400 pm.

Los angeles county tax collector payment.

Substitute secured property tax bill.

Businesses with personal property and fixtures that cost 100000 or more must file a business property statement annually by april 1.

The office of the assessor has the following four primary responsibilities.

Acceptable forms of payment in person include cash check cashiers check or money order.

Assessor auditor controller treasurer and tax collector and assessment appeals board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in los angeles county.

10 and april 10.

To apply all legal exemptions.

These links are most viewed by.

Businesses are also subject to property tax which is billed each october and due by dec.

How to read your property tax bill.

Information on property tax exemptions exclusions value reviews and formal appeals of appraised value.

Annual secured property tax bill insert.

The property tax portal gives taxpayers an overview and specific details about the property tax process in los angeles county.

We are located at the kenneth hahn hall of administration 225 north hill street los angeles california 90012.

Unsecured prior year bill.

Annual secured property tax bill.

To complete an assessment roll showing the assessed values of all property.

Annual secured property tax information statement.

Customers may make payments in person at any of environmental healths office locations throughout los angeles county or by mail.

Supplemental secured property tax bill.

To establish a taxable value for all property subject to property taxation.

Exclusion tax relief.

Assessor auditor controller treasurer and tax collector assessment appeals board assessor the los angeles county assessor establishes the assessed value of your property by appraising the value of that property under applicable state law.

Los angeles county office of the assessorcounty of los angeles.

Unsecured property tax bill.

Thank you for visiting the website site for the los angeles county treasurer and tax collector we us or our.

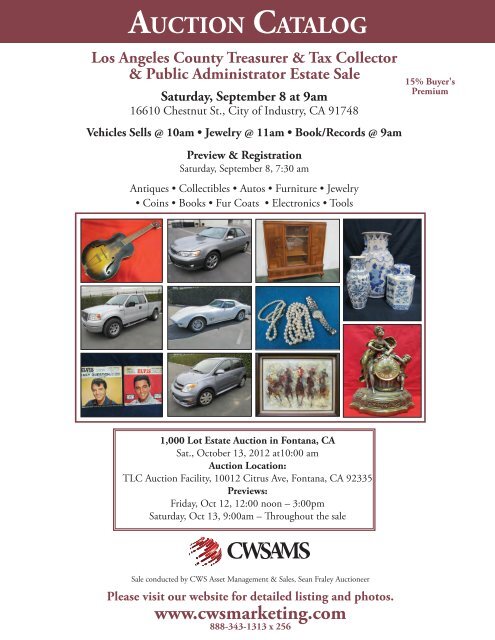

Los Angeles County Treasurer Tax Collector Cws Marketing

Ca Property Tax Bill November 2015 Installment Desiree Lapin

California Homeowners Get To Pass Low Property Taxes To Their Kids

Prepay Property Taxes Nope

Origin Based And Destination Based Sales Tax Collection 101

Treasurer Tax Collector Los Angeles County

Exclusive Bp Oil Received 1 Billion In Property Tax Reduction From

New Seal Yelp

Los Angeles County Treasuer And Tax Collector Civic Center 225 N

0 comments:

Post a Comment