It should not be relied upon to calculate exact taxes payroll or other financial data. Now updated with tax withholding guidelines based on the new tax plan. In this webinar well go over key steps you should take now to implement these new changes and well examine best practices on how to communicate them to your affected employees.

take home pay calculator california adp

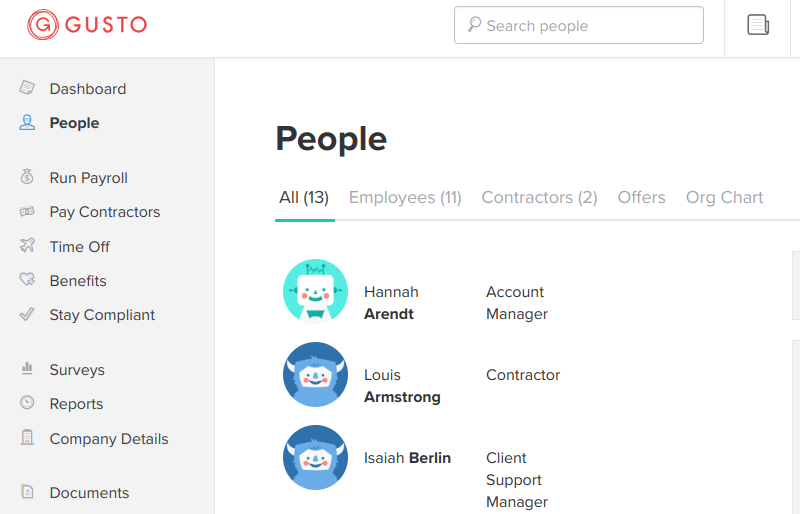

Gusto Vs Adp Vs Paychex Price Features Comparison 2019

Adp Pay Stub Template Free Awesome Adp Template For Pay Stubs Port

Payroll Hourly Calculator Tacu Sotechco Co

Hourly paycheck calculator enter up to six different hourly rates to estimate after tax wages for hourly employees.

Take home pay calculator california adp.

Use the take home pay calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

This powerful tool does all the gross to net calculations to estimate take home net pay in any part of the united states.

See how your paycheck will change from 2018 to 2019 by entering your per period or annual salary along with the pertinent federal state and local w 4 information in our tax reform calculator.

Payroll check calculator is updated for payroll year 2018 and will calculate the net paycheck amount that an employee will receive based on the gross payroll amount and employees conditions such us marital status frequency of pay payroll period number of dependents federal and state exemptions.

Please note that it is mainly intended for use by us.

Important note on calculator.

Arizona salary paycheck calculator.

The calculator on this page is provided through the adp employer resource center and is designed to provide general guidance and estimates.

2019 tax reform calculator.

Use smartassets california paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

If you dont want to do it the easy way you can figure out take home wages for your employees every period with a paycheck calculator like the one below.

This powerful tool does all the gross to net calculations to estimate take home net pay in any part of the united states.

Calculate your net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local w 4 information into this free arizona paycheck calculator.

Salary paycheck calculator important note on calculator.

This calculator gives results based on tax brackets of both 2018 and 2019 tax brackets tax cuts and jobs act or trump tax.

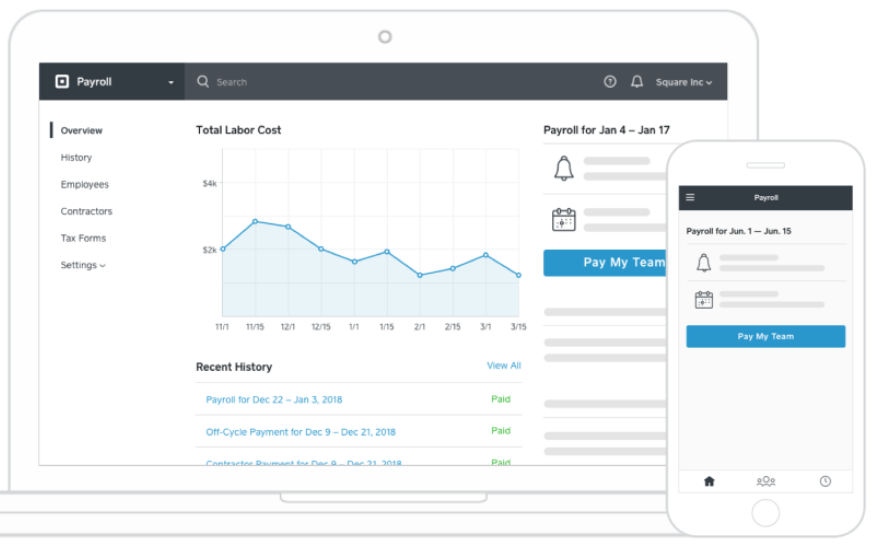

Tax management federal state and local payroll taxes calculated filed and paid for you automatically.

Surepayroll gives you peace of mind.

The calculator on this page is provided through the adp employer resource center and is designed to provide general guidance and estimates.

The rules more than double the minimum salary threshold for employees to qualify as exempt from overtime from 23660 a year to over 47000.

Adp Private Payrolls Add 275k In April Vs 177k Estimate

Adp Take Home Pay Hashtag Bg

Resources

California Snapshot Payroll Company Not Liable For Alleged Wage

Small Business Hr And Payroll Software Solutions

Adp Payroll Stub Pay Stubs Sample Paychecks Paycheck Calculator

Payroll Basics For Adp Workforce Now

7 Adp Payroll Competitors At Half The Price

California Pay Stub Generator Fill Online Printable Adp Pay Stub

0 comments:

Post a Comment