You and your ira are two separate entities. Real estate in an ira can be purchased. A self directed ira is a type of retirement account legally structured like a traditional or roth ira.

self directed ira real estate rules

Infographic Self Directed Ira Faq Who Is A Disqualified Person

Self Directed Ira For Real Estate How It Works Real Estate Ira Rules

Top Ten Frequently Asked Self Directed Ira Questions And Answers

When it comes to real estate properties owned by your ira.

Self directed ira real estate rules.

The best approach is to think of yourself as a fund manager for your future self.

A self directed ira is not a way for you to invest in real estate or other alternatives and have access to plan capital to do so.

Dont perform services on the property.

You cannot have indirect benefits from property owned by your self directed ira.

This could lead to the disqualification of the ira and result in severe tax consequences.

A self directed ira is a traditional or roth ira in which the custodian permits a wide range of investments that are allowable in retirement accounts.

Ira faqs investments.

Ira investments in other unconventional assets such as closely held companies and real estate run the risk of disqualifying the ira because of the prohibited transaction rules against self dealing.

While a checkbook control self directed ira is popular for ira investors interesting in making real estate investments involving a high frequency of transactions such as rental properties fix and flips tax liens and hard money loans.

7 self directed ira real estate investment rules 1.

If you dont follow the rules for self directed iras you can risk the tax deferred status of your account.

Five things to consider before buying real estate with a self directed ira.

Ira investments are uniquely titled.

Real estate ira rules your ira cannot purchase property owned by you or a disqualified person.

Dont rent to your kids.

The rules prohibit transactions between the ira and certain individuals known as disqualified persons.

Every year the irs requires a report of the fair market value fmv.

One of these alternative options real estate investments is appealing to many people who consider using a self directed ira to purchase rental properties.

Self directed ira real estate rules.

Prohibited transactions the basis of the prohibited transaction rules are so ira investments benefit the retirement account and not the ira owner.

Rather it is simply a means for your retirement plan to diversify.

This rule also applies to an indirect acquisition such as having an ira owned limited liability company llc buy the bullion.

Prohibited transactions and investments discover what investments your ira cannot make pursuant to irs guidelines.

If You Opt To Use A Self Directed Ira To Purchase Real Estate Be

What Is A Self Directed Ira Rules Contribution Limits Investment

About Us Self Directed Ira Attorney Self Directed Ira Llc Self

How To Use A Self Directed Ira To Buy Real Estate Ira Resources

Self Directed Real Estate Ira Advanta Ira

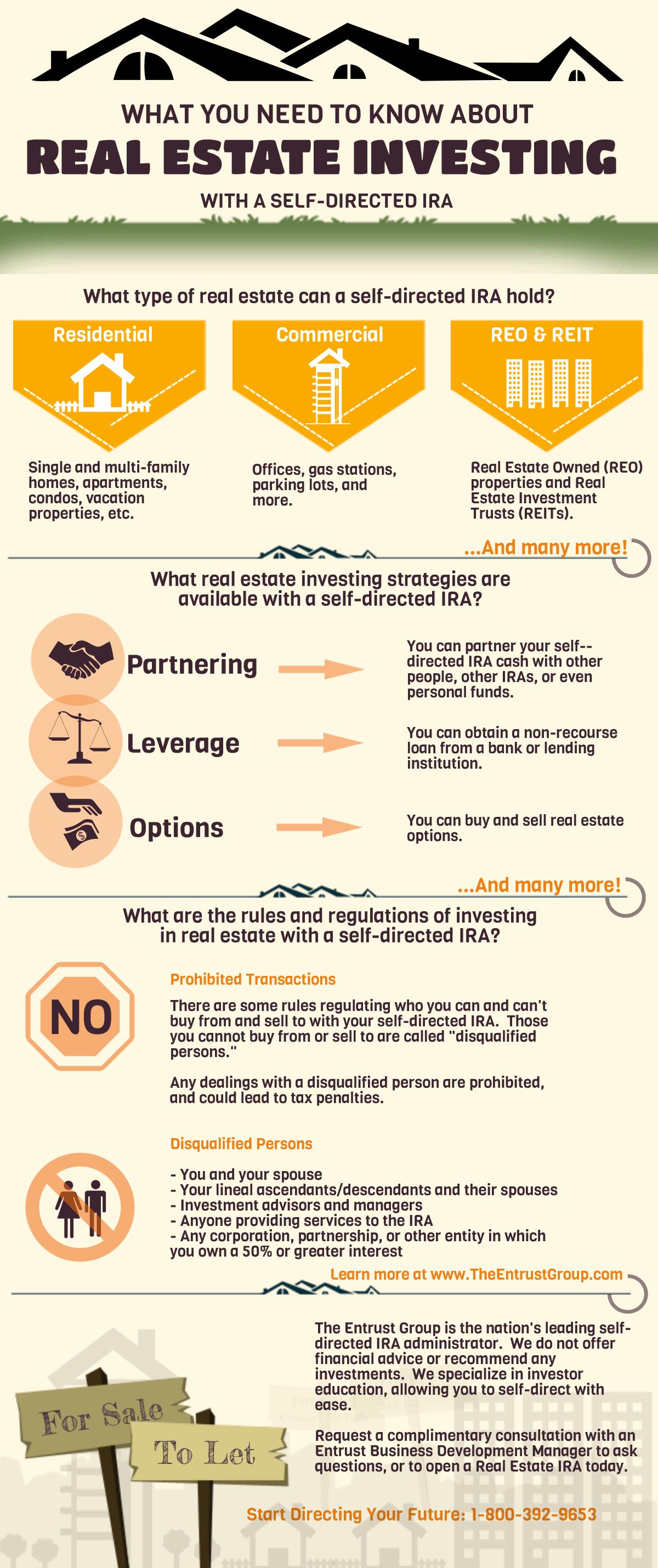

Infographic What You Need To Know About Real Estate Investing With

The Real Estate Ira Investor And Rmds Pensco

Real Estate Ira Rules Any Interested Ira Owner Should Know

Using Your Ira To Buy Real Estate Pdf

0 comments:

Post a Comment