Term life insurance is well suited for meeting lifes goals. Making sure there will be money for your kids to go to college is a popular use for term life policies but there are also policies that are designed to pay off a mortgage the value of the policy decreases over time to match the mortgage shrinking as it is paid off. Whole life insurance is a type of permanent life insurance designed to provide lifetime coverage.

what's the point of life insurance

Applying For Term Life Insurance What S The Process

Group Term Life Insurance Questions To Ask Yourself Today Ieee

Term Vs Whole Life Insurance What S The Best Option For You

Because of the lifetime coverage period whole life usually has higher premium payments than term life.

Whats the point of life insurance.

In addition to student loans auto loans and mortgage debt.

What is the point of life insurance.

Your children spouse siblings parents or partner do not need help with your expenses when youre gone.

There are two main type of life insurance that you should be aware of.

They dont need mo.

If your claim fulfills the terms of the policy your beneficiaries will receive a death benefits that can help replace lost income and pay expenses.

The two main types of life insurance are term and permanent whole.

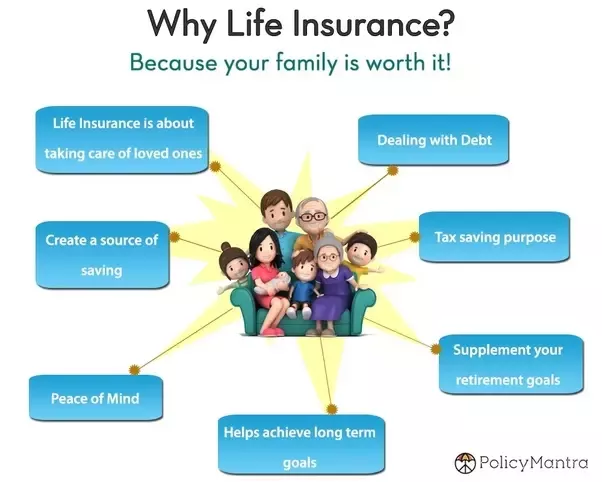

Benefits of life insurance.

This is designed to pay out a death benefit to your dependents if you die within the term that you have insured yourself for.

If you have financial liabilities future obligations or charitable intent and you care about family business associates or your charity then life insurance is the product to point to.

Life insurance can provide your beneficiaries with the cash flow to help pay your loans and settle your accounts quickly.

The first is called term life insurance.

In certain circumstances a large pension fund can mean that a life insurance policy is surplus to requirements.

You should consider the amount of assets and sources of income available to your dependents when you pass away.

Social security benefits available cash and other sources of income and investments may not provide.

Life insurance can help provide financial security to your loved ones if you were to die unexpectedly.

Life insurance provides your loved ones with a source of income after your passing.

Thats not to say you should start spending recklessly if you have a large life insurance policy of course.

They dont need help paying for your funeral.

The purpose of life insurance.

There is no point to life insurance since you cant spend it.

This is because on death before retirement defined contribution and personal pension funds can be paid to your beneficiaries as a lump sum free of inheritance and other taxes.

The point of life insurance is to protect your family members business associates or charitable organizations from economic loss if you were to be gone from the picture.

The amount of insurance you buy should depend on the standard of living you wish to assure your dependents.

Life Insurance Support American Fidelity

Best Life Insurance Companies For 2019 The Simple Dollar

Life Insurance As Investment What Not To Do Cosmobc Com Bizblog

What S The Best Life Insurance Policy For A 35 Year Old Quora

7 Ways Life Insurance Will Not Pay Out True Blue Life Insurance

Alex Trebek Life Insurance Learn The Truth About This Life

The Differences Between Term And Whole Life Insurance

Whole Life Insurance Faqs What S The Best Way To Compare Whole Life

What S Wrong With Life Insurance Blog Elifelabs

0 comments:

Post a Comment